Steve Andrews, Commercial Manager, ISSB

As with most industries, the UK scrap export market has undergone some considerable changes over the past few years. Comparing the first eight months of the year, exports of ferrous scrap declined by 22% in 2020 as COVID-19 lockdowns affected various export markets. Exports quickly bounced back to pre-COVID levels, however, with a 31% on 2020 and a 2% growth compared to 2019.

The export market has long been very important for the UK scrap industry. More ferrous scrap is shipped to Turkey alone than is used in the UK. This remained the case this year and a strong steel industry in Turkey has meant that UK exports so far in 2021 were 19% higher than in the same period of 2019 with a total of 1.7 million tonnes shipped to the country in the first eight months of the year.

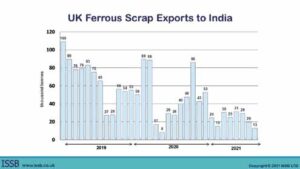

Aside from Turkey, we have seen some substantial changes in the destinations for UK scrap. There has been a decrease in exports to the Indian subcontinent with shipments to India down 69%, exports to Pakistan falling by 22% and exports to Bangladesh declining by 27%. Increasing shipping costs in particular have led India to source more scrap locally with a medium-term goal of becoming more self-sufficient in terms of steel making raw materials.

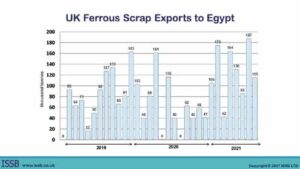

Offsetting this decline in exports to India has been a huge increase in the export of ferrous scrap to Egypt. Shipments to Egypt have nearly doubled in the past two years and in the first eight months of this year, the UK exported more than 1 million tonnes to the country, making it the second largest importer, after Turkey.

Elsewhere we see a decline in exports to Spain offset by a rapid rise in exports to Italy with large increases also seen to the US, Malaysia and Kuwait.

Non-ferrous scrap

Overall exports of non-ferrous scrap have not yet returned to their pre-COVID levels with an 8% decrease when compared to 2019. This was driven by a 33% decline in copper scrap exports with exports to Bangladesh stopping entirely and shipments to China also reducing. This decline was partially offset by an increase in aluminium and lead scrap exports, growing by 11% and 6% respectively on 2019 levels.

Within aluminium we have seen a steady decline in exports to China being more than offset by a growth in shipments to India, South Korea and Thailand with the growth in lead scrap exports being driven by increased shipments to Thailand, India and Pakistan. Elsewhere Nickel scrap exports fell, mainly due to a reduced tonnage being shipped to the US but Zinc scrap exports increased slightly on the back of increased exports to Benelux and Vietnam.

Globally we are seeing evidence of increased drives for self-sufficiency in the scrap market with some countries such as Russia enacting duties on scrap exports which is a trend likely to continue in some areas but longer term, the drive for lower carbon emissions is likely to fuel continued demand for scrap globally with the export market remaining very important for the UK industry.

ISSB is a leading supplier of global trade data for steel, non-ferrous metals and raw materials, offering monthly import and export data for over 80 countries split by tariff codes, covering hundreds of products. Their online database enables up to date analysis and interrogation of this trade data to establish trends in both volumes and prices covering all major markets. www.issb.co.uk